Polyurethane Market Analysis 2025 – Supporting High-Stakes Corporate Planning

Unlock 30% off global market reports with code ONLINE30 – get insights on tariff changes, macro trends, and global economic shifts.

What is the projected value of the polyurethane market by 2029?

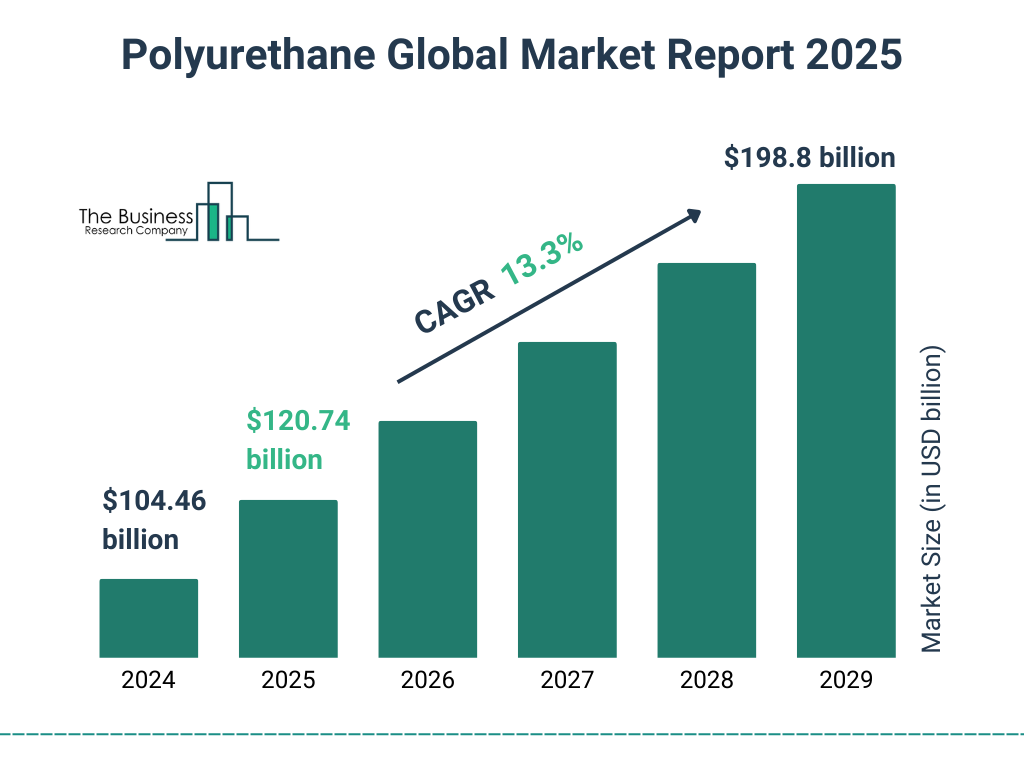

The polyurethane market size has grown rapidly in recent years. It will grow from $104.46 billion in 2024 to $120.74 billion in 2025 at a compound annual growth rate (CAGR) of 15.6%. The growth in the historic period can be attributed to construction and insulation, automotive industry, furniture and bedding, coatings and adhesives.

The polyurethane market size is expected to see rapid growth in the next few years. It will grow to $198.8 billion in 2029 at a compound annual growth rate (CAGR) of 13.3%. The growth in the forecast period can be attributed to sustainability and green initiatives, energy efficiency in buildings, automotive lightweighting, medical devices and healthcare. Major trends in the forecast period include bio-based polyurethanes, smart materials, customized formulations, 3d printing with polyurethanes.

Download Your Free Sample PDF:

Polyurethane Market Report 2025

How are technological advancements fueling growth in the polyurethane market?

The adoption of polyurethane in home furnishings is driving the polyurethane market. Furniture manufacturing companies are enhancing comfort, durability, health, and safety by using flexible polyurethane foam (FPF) as a cushioning material for upholstered furniture, bedding, and carpet underlay. Furthermore, with the introduction of an advanced manufacturing process, polyurethane foam provides more uniform, predictable, and durable end products. For instance, according to the American Chemistry Council, it is proven that FPF, when compressed by 90% for 22 hours, can recover more than 90% of its original height, which is more durable than any other form of furniture material. Moreover, completely cured polyurethane products are considered to be inert and safe and have been concurred with by the U.S. EPA (Environmental Protection Agency). The durability, comfort, and safety provided by polyurethane will continue to be the major reasons for its use in the furniture industry, thereby driving the demand for the polyurethane industry going forward.

Which segment currently leads the polyurethane market in terms of revenue share?

The polyurethane market covered in this report is segmented –

1) By Product Type: Coatings, Adhesives and sealants, Flexible and rigid foams, Elastomers, Other Product Types

2) By Raw Material: MDI, TDI, Polyols

3) By End User Industry: Furniture, Construction, Electronics And Appliances, Automotive, Footwear, Other End Use Industries

Subsegments:

1) By Coatings: Waterborne Coatings, Solvent-Borne Coatings, Powder Coatings, UV-Cured Coatings

2) By Adhesives And Sealants: Structural Adhesives, Non-Structural Adhesives, Hot-Melt Adhesives, Pressure-Sensitive Adhesives, Polyurethane Sealants

3) By Flexible And Rigid Foams: Flexible Foams (Mattress, Furniture, Automotive), Rigid Foams (Insulation Materials, Refrigerators, HVAC)

4) By Elastomers: Thermoplastic Polyurethane (TPU), Thermoset Polyurethane Elastomers

5) By Other Product Types: Synthetic Leather, Polyurethane Rubbers, Polyurethane Resins, Polyurethane Elastomers For Footwear

View The Full Market Report:

Polyurethane Market Report 2025

What technological trends are expected to redefine the polyurethane market?

Demand for sustainable products from the construction, automotive, and footwear industries is witnessing a rising demand for the manufacturing of bio-based polyurethane (PU) with a rising awareness of environmental concerns worldwide. Bio-based polyurethanes (PU) are derived from biodegradable materials, constituting a rich source of precursors for the synthesis of polyols and isocyanates. These chemicals are readily available at a lower cost with less environmental impact and are highly biodegradable. In addition, with increasing commercialization and growing demand for flexible foam for car seats and headrests from major automotive OEMs, polyurethane manufacturers have shifted focus towards developing sustainable and environmentally friendly products of renewable materials. This will drive the use of bio-based polyurethane products in various industries, including construction, automotive, coating, and footwear. For instance, in September 2022, Covestro AG, a Germany-based high-performance polymers materials company launched polyether polyols. These polyols are utilized in various products, such as molded foams, flexible foams, adhesives and sealants, and elastomers. Rigid polyurethane foams, which are utilized for insulation in buildings, appliances, and transportation, are also made using these materials. These foams have great thermal insulating qualities.

Who are the top competitors in the global polyurethane market?

Major companies operating in the polyurethane market include Dow Chemical Company, BASF SE, Covestro AG, Huntsman Corporation, Eastman Chemical Company, Mitsui Chemicals Inc., DIC Corporation, Nippon Polyurethane Industry Corp. Ltd., Recticel S.A., Woodbridge Foam Corporation, RTP Company Inc., Lanxess AG, Lubrizol Corporation, Tosoh Corporation, DuPont de Nemours Inc., Perstorp AB, Manali Petrochemicals Ltd., Wanhua Chemical Group Co. Ltd., Rampf Holding GmbH & Co. KG, FXI Holdings Inc., Kuwait Polyurethane Industries WLL, Recticel SA, Rogers Corporation, Sheela Foam Ltd., INOAC Corporation, American Urethane Inc., TPC Inc., Weaver Industries Inc., FallLine Corporation, Uniflex Inc.

What regional dynamics are shaping the future of the global polyurethane market?

Asia-Pacific was the largest region in the polyurethane market in 2023. North America was the second-largest region in the global polyurethane market. The regions covered in the polyurethane market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa.

How Can Companies Use The Polyurethane Market Report to Drive Business Results?

This report provides actionable insights tailored for business use—not academic analysis. Companies can leverage the data to:

• Time market entry or expansion using growth forecasts and CAGR trends.

• Develop competitive products by tracking key technology shifts and user preferences.

• Tailor regional strategies with in-depth geographic data and local market dynamics.

• Benchmark and plan partnerships using competitive landscape insights.

Purchase The Report And Get A Swift Delivery:

Polyurethane Market Report 2025

Need Customized Data On Polyurethane Market?

For companies needing more tailored intelligence, The Business Research Company offers customized consulting and data services. Whether you're entering new regions, launching innovative products, or assessing M&A opportunities, our experts can develop actionable insights specific to your business objectives.

Request Customized Data:

https://www.thebusinessresearchcompany.com/customise?id=2706&type=smp

About The Business Research Company:

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model, is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Contact Us:

The Business Research Company

https://thebusinessresearchcompany.com/Americas +1 310-496-7795

Europe +44 7882 955267

Asia & Others +44 7882 955267 & +91 8897263534

Email us at info@tbrc.info

Follow Us On:

LinkedIn: The Business Research Company | LinkedIn

Comments

Post a Comment